U.S. Health IT Community Positive on AI, but Fearful of “Data in the Wild”

• Potential

• Current Adoption

• Challenges

• Risks

The results from 2024 VIVE and HIMSS conference attendees are detailed below.

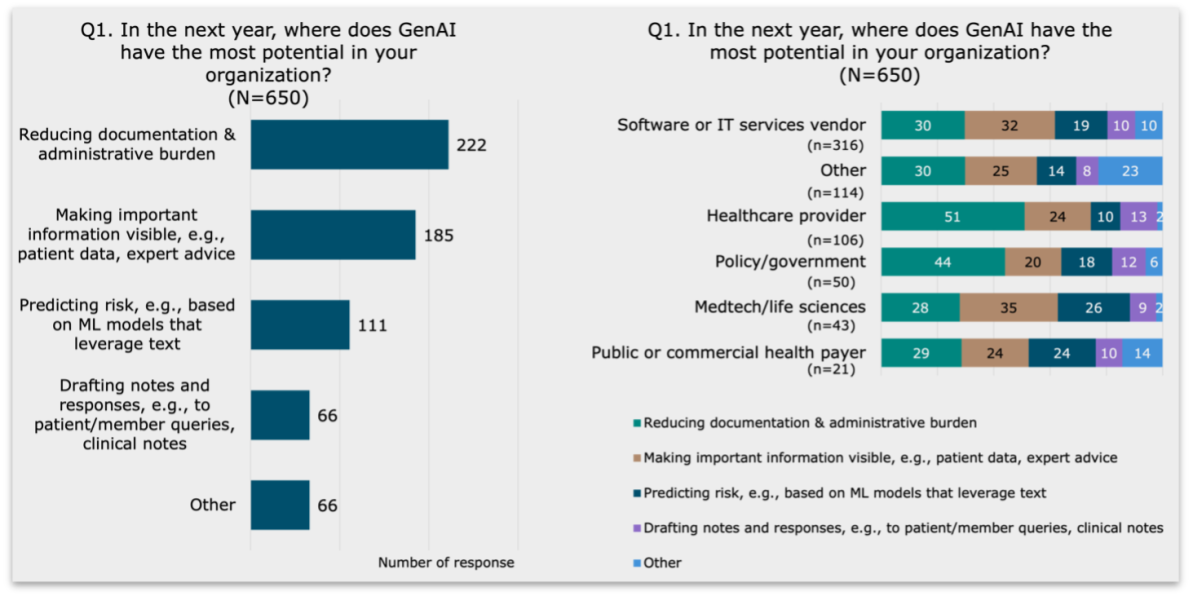

Q1: Where does GenAI have the most potential in your organization?

Respondents skewed heavily toward two use cases: reducing burden and making important information visible. This aligns well with general industry tensions over clinician burnout and understaffing. When examined by sector, though, the results were less clear cut, indicating that the provider and government sectors contributed heavily to this skew.

Figure 1: Views on Greatest Potential in Total and as Percentages by Industry Sector

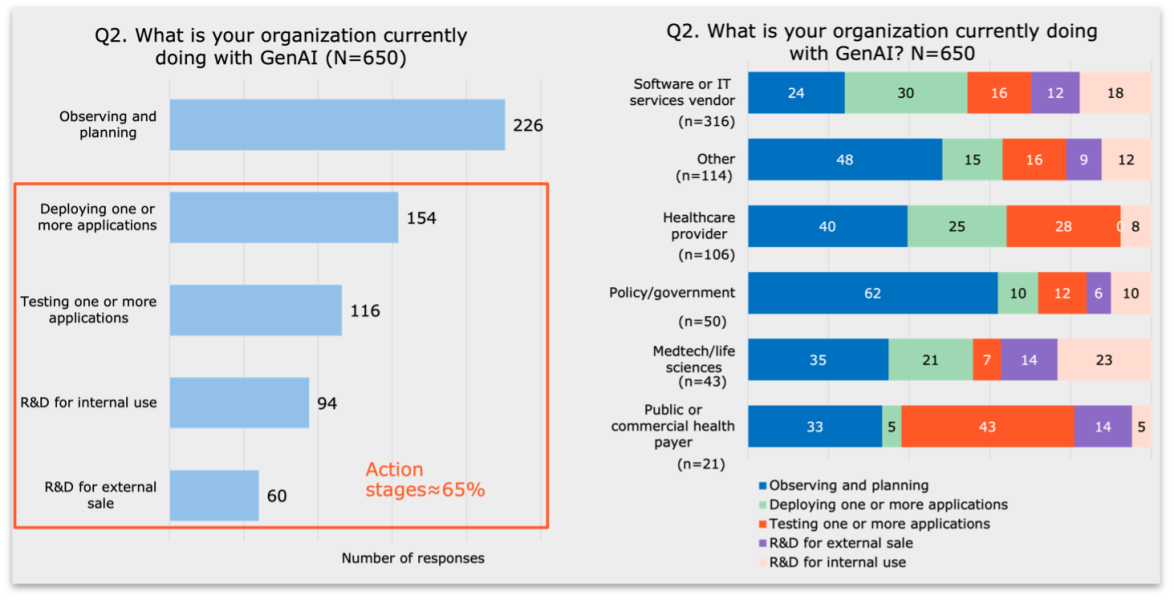

Q2: What is your organization currently doing with GenAI?

Roughly one-third of respondents are watching and planning what to do with AI, while two-thirds are moving ahead testing, deploying, and developing capabilities. Again, there were definite differences by sector. Not surprisingly, the IT vendors in the sample are most aggressively moving forward, and government respondents are the most likely to be watching.

Figure 2: Current Adoption Levels in Total and as Percentages by Industry Sector

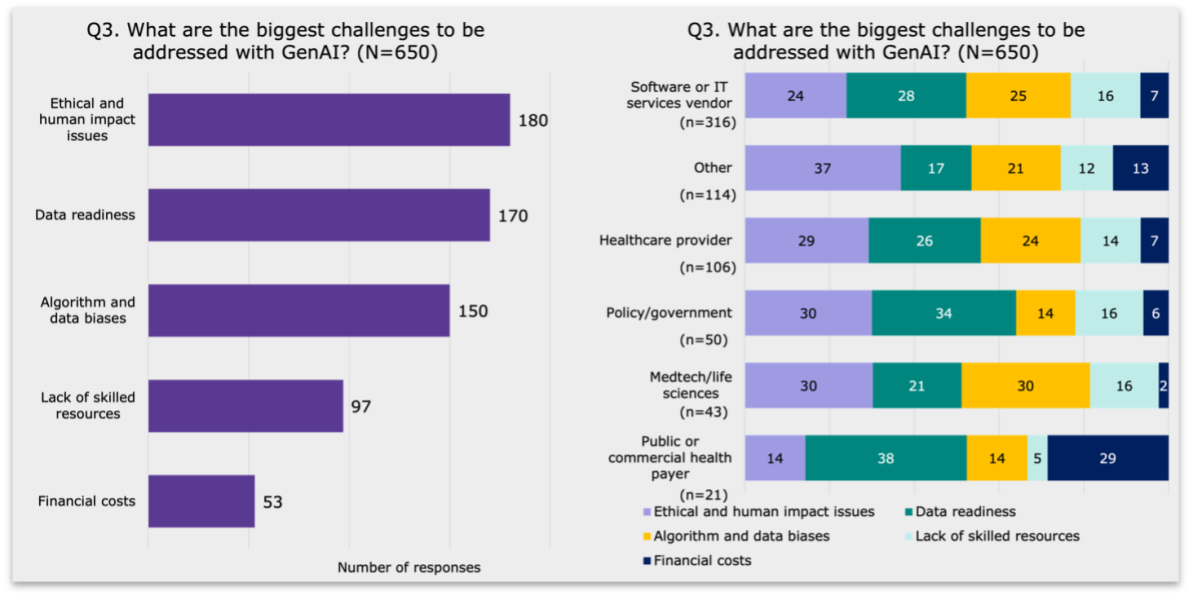

Q3: What are the biggest challenges to be addressed with GenAI?

When asked about the biggest challenges to be addressed, the biggest news was in the low-ranking responses. Somewhat counter-intuitively, for an industry plagued by labor shortages, neither staffing nor costs received a lot of votes. Whereas ethical concerns, data readiness and biases were virtually tied for top choice. The most anomalous sector was the small payer sample, which was most concerned with data readiness, followed by technology costs.

Figure 3: Perceived Challenges in Total and as Percentages by Industry Sector

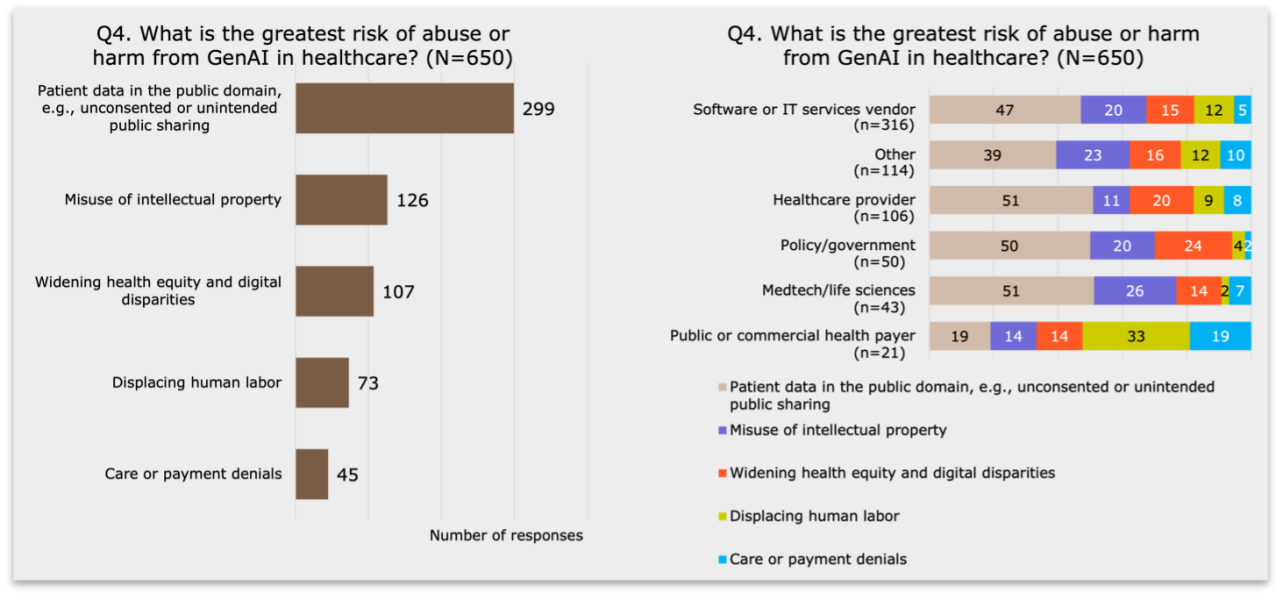

Q4: What is the greatest risk of abuse or harm from GenAI in healthcare?

When asked about risks, the overwhelming sentiment of respondents was that the greatest risk by far is that either through unconsented or unintended uses, patient health data will leak into the public domain. This was true across all sectors except for the 3% of respondents in the payer sector. That group was more concerned with the impact to human labor.

Figure 4: Greatest Risks in Total and as Percentages by Industry Sector

Summary

The overall sentiment of the audience was upbeat – when asked whether they viewed the technology pessimistically or optimistically, the average rating was a 4 out of 5, solidly positive. This audience also seems particularly concerned with getting it right – protecting patient records, addressing ethical and bias issues, and ensuring the data is ready for use.

InterSystems will continue collecting data throughout 2024 as AI moves from demo to widespread deployment across the healthcare sector.