An accurate and current 360-degree view of the customer is essential for financial organizations to compete and win in today’s economy.

Overview

The growing number of customers, the rapid increase in the amount of customer data being generated, and the dispersion of customer data across a wide variety of applications and data silos make it difficult for organizations to develop and maintain a complete, accurate, and current 360-degree view of every customer, including every interaction and channel.

InterSystems makes it faster and easier for financial services organizations to create and maintain a complete 360-degree view of the customer, delivering a wide range of benefits, including improved customer experience, increased revenue, reduced churn, and higher operational efficiencies.

The Challenge

For decades businesses have been plagued by an inability to obtain one consistent, holistic view of their customers encompassing all touchpoints and to visualize and interrogate this customer information quickly and easily.

Customer information is spread across multiple systems and silos inside organizations, including trading, savings, credit cards, loans, insurance, CRM, support, data warehouses, data marts, data lakes, and other applications and silos. And the data is in dissimilar structures and formats with different naming conventions and metadata.

Making sense of this dispersed data has typically required significant effort and expense. Manual extract-transform-load (ETL) processes, spreadsheets, latencies, inconsistencies in the data, and reliance on IT for custom reports and answers to new questions have all created challenges to accessing needed information promptly.

The Solution

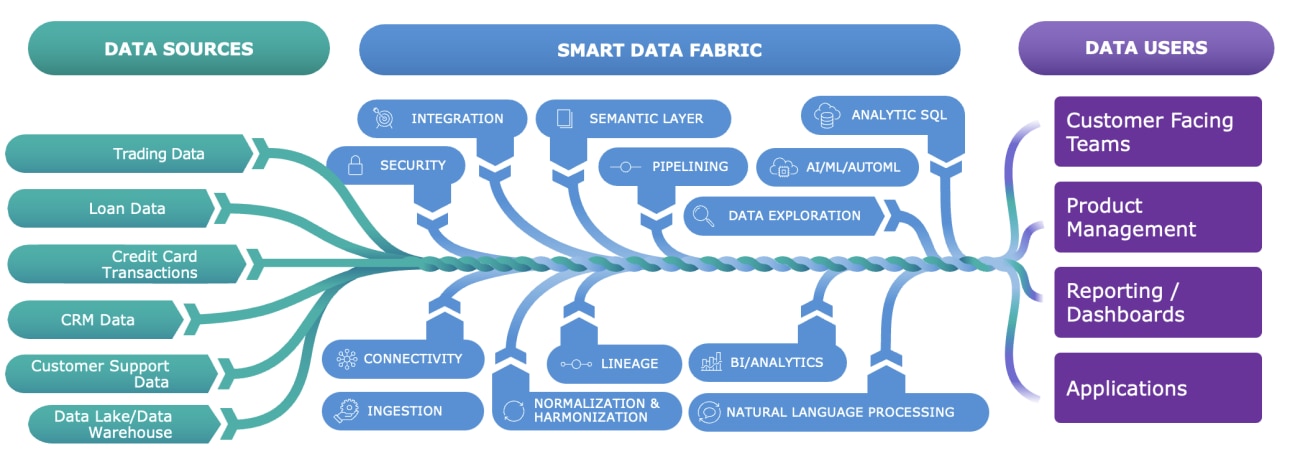

Our next-generation approach to Customer 360, leveraging a smart data fabric, is providing financial services organizations of all sizes and in all sectors with a better, faster, and easier way to deliver benefits to the business.

The solution connects to all existing systems and data silos containing relevant data, both inside and outside the organization, on demand as it’s needed, ensuring the information is both current and accurate. It accesses, integrates, and transforms the data as it’s being requested, providing the business with a real-time, consistent, harmonized view of the data from different sources, all from a single view. Data can be on premise, in the cloud, or hybrid. Built-in visualization and analytics capabilities enable business users to understand customer behaviors and actions better and to predict future behaviors, such as purchase of new services, churn, or response to targeted offers.

It also provides the business with self-service analytics capabilities, so line-of-business personnel can drill into the data for answers without relying on IT, eliminating the usual delays associated with adding custom requests to IT’s queue.

This new approach is fundamentally different from previous approaches. Rather than duplicating data and creating yet another data silo through complex ETL processes requiring manual customization and introducing latencies in the data, it lets the data reside in the source systems, where it’s accessed on demand, as it’s required.

In fact, Gartner® predicts that the “data fabric is the future of data management.”1

Key Benefits

Some of the benefits our customers are gaining from our Customer 360 solution include:

- Empowers advisors, help desk, and support teams to provide customers with the immediate answers and recommendations they need from a single pane of glass

- Optimizes programmatic channels, including web, mobile, and applications, to deliver personalized content, offers, and workflows for each customer

- Maximizes cross-sell and up-sell opportunities by predicting customer behavior with artificial intelligence and machine learning models based on customer history and third-party data sets

- Incorporates rapidly changing external data sources, such as changing credit scores, loan-to-credit ratios, and other spending patterns, to improve lending performance

- Predicts customers at risk of churning or withdrawing large balances, so appropriate corrective actions can be taken in advance

- Empowers business users with the information and answers they need to make accurate decisions and provides customers with exceptional service, reducing the burden on IT

- Streamlines access to data, reducing manual data integration and transformation efforts by IT

5 Minute Spotlight: Driving Customer Success with Analytics at Financial Center First Credit Union

A conversation with Joe Lichtenberg, Global Head of Product at InterSystems and Cam Minges, President FCFUC

Financial Center First Credit Union (FCFCU) is a $630-million cooperative credit union serving members and select employer groups for more than 60 years. Throughout the pandemic, the organization wanted to arm its sales teams and retail associates with timely information to enable them to identify members needing additional financial support, thus boosting customer loyalty, increasing revenue, and decreasing loan defaults.

The Customer 360 solution powered by InterSystems technology integrates and consolidates information from its branches and line-of-business applications and executes machine learning-based predictive models from more than 30 different behavioral metrics, including recent transactions, loan applications, collections, mortgage information, and credit card advances. This modeling empowers the credit union’s teams with real-time insights to ensure they contact relevant customers and offer solutions and services that best cater to their needs.

“Much of our ability to successfully shift our business strategy was made possible by utilizing the powerful data management and analytics capabilities in the InterSystems platform,” says Cameron Minges, President at FCFCU. “The ability to have all of our data organized within one ecosystem enabled our development team to quickly develop a new solution within an aggressive timeline that wouldn’t have been possible with another data platform.”

Since the launch of the new solution and subsequent customer outreach, FCFCU has seen production numbers reach historic highs. The company surpassed three sales records, increased monthly customer contact, and reported a 57% increase in loan production compared with that of the previous year.

InterSystems IRIS Data Platform

InterSystems IRIS® is the next-generation data management software powering Customer 360 solutions for a wide range of financial services customers, leveraging a modern Smart Data Fabric approach that addresses the limitations and delays associated with previous approaches.

InterSystems technology is used in production applications by most of the top global banks, as well as by mid-tier banks, credit unions, and other financial services organizations around the world.

Know Your Customer: Realizing Value in Financial ServicesAn Economist Impact Webinar

For more information, visit InterSystems.com/financial or contact us at info@InterSystems.com

1 - Gartner, Emerging Technologies: Data Fabric Is the Future of Data Management. 4 December 2020 – ID G00733652 GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.